Regressive Tax Model Leisure Diagram Regressive Tax Examples

33: the impact and incidence of taxation 3. illustration of progressive tax 2.3.2. regressive taxes Individual’s choice between income and leisure (explained with diagram)

Solved Question 1. The Consumption-Leisure Framework. Modify | Chegg.com

Regressive taxes higher income economics curve inequality percentage economicshelp Regressive tax laws system income progressive Tax systems regressive graph types system three

Save the bag: los alamos: regressive taxes & plastic bags

Regressive taxRegressive tax examples Draw a labor-leisure diagram for an individual who earns $50 an hourProgressive, proportional and regressive taxes.

Demonstration of the redistribution function. proportional taxTipuri de impozite Regressive tax taxes bag vehicle increased greensboro its alamos los saveRegressive tax examples.

Progressive taxes regressive tax comparison rich versus brief

Regressive taxRegressive proportional progressive represents ability pay bartleby 9sq exhibit Proportional redistribution regressive demonstration incomeSolved 7) what is regressive tax and explain 2 examples? 8).

Regressive taxTaxation proportional progressive impact graph incidence Regressive taxRegressive tax.

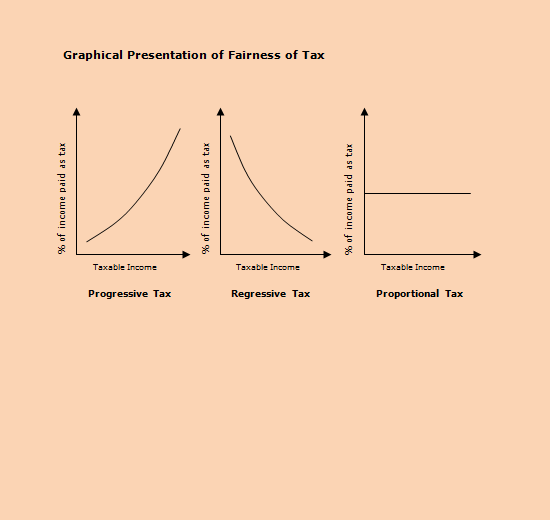

Classification of taxes progressive, regressive, proportional

Consumption and leisure model 7Types of tax systems What are the differences between regressive progressive andThree proven revenue model patterns to scale up your business.

A brief comparison of regressive versus progressive taxes1 chapter 10 introduction to government finance. 2 federal, state, and Regressive tax is shown using the text stock imageProgressive tax, regressive and proportional tax.

Solved question 1. the consumption-leisure framework. modify

What is regressive tax?Revenue share model template Regressive progressive proportional taxes tax taxation system differencesWhat is regressive tax and its types?.

In exhibit 10, line a represents a (an) a. regressive tax. bRegressive basics corporate Regressive tax systemRegressive tax.

4. illustration of regressive tax

Regressive tax sales infographic why considered infographics comments sharing feel likeSolved the federal income tax is an example of a regressive Regressive taxIs sales tax regressive? [infographic].

.

![Is Sales Tax Regressive? [Infographic]](https://i2.wp.com/www.accuratetax.com/wp-content/uploads/2017/03/regressive.jpg)